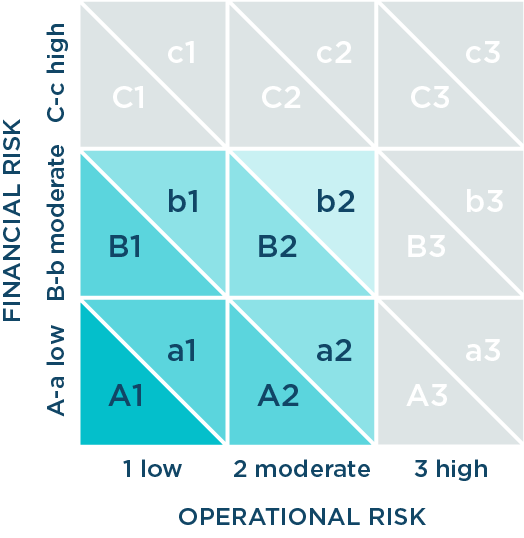

Exægis’s rating model is based on matrix analysis.

Christophe Poudrai,

Rating model for a digital service provider (TRUXT label)

For digital service providers with revenue of less than €15m, an Exægis rating is awarded following a two-step audit :

The financial analysis :The company is audited by an independent financial analyst. The analysis identifies the risk of failure in the short- and medium-term.

The financial analysis gives a rating ranging from “A” (very low financial risk) to “C” (very high financial risk).

The operational analysis : The analysis continues with a series of on-site interviews from which the company’s operational risk is evaluated.

The operational analysis gives a rating ranging from “1” (very low operational risk) to “3” (very high operational risk).

The operational audit covers 7 chapters with a total of 150 watch points :

For each of these chapters, we compare the company’s practices to our good operational practices benchmark for digital companies.

The overall rating is obtained by cross-referencing the financial risk and operational risk ratings and is accompanied by a detailed audit report setting out the organisation’s risk profile.

The company can improve its risk profile using appropriate action plans and have its risk rating updated annually to reflect this.

Companies that obtain a rating between A1 and b2 are eligible for the TRUXT label.

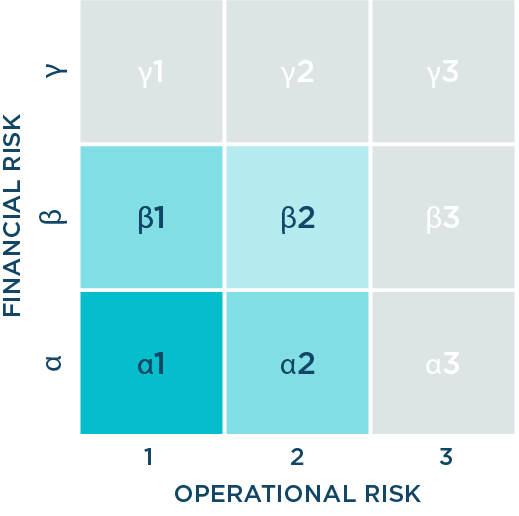

Rating model for a digital start-up (starTRUXT label)

For digital start-ups, an Exægis rating is awarded as a result of a two-step audit :

The financial analysis :The start-up is audited by an independent financial analyst. This analysis examines the start-up’s aims, strategy, business model and business plan, and how the business plan is being implemented.

Analysts work with the Exægis Research department to analyse and interpret the key market data (market definition, volume, depth and trends) used in the business plan.

The analysis of the business plan and business model gives a rating ranging from “α” (very low financial risk) to “γ” (very high financial risk).

The operational analysis :

The analysis continues with a series of on-site interviews from which the start-up’s operational risk is evaluated.

The operational analysis gives a rating ranging from “1” (very low implementation risk) to “3” (very high implementation risk)..

The operational audit covers 4 chapters with a total of 169 watch points :

For each of these chapters, we compare the start-up’s practices to our good operational practices benchmark for digital start-ups.

We drew up our standards in 2012 based on international standards, and have supplemented and enriched them with input from the hundreds of ratings projects we have carried out since.

The overall rating is obtained by cross-referencing the financial risk and operational risk ratings and is accompanied by a detailed audit report setting out the start-up’s risk profile.

The start-up can improve its risk profile using appropriate action plans and have its risk rating updated annually to reflect this.

Start-ups that obtain a rating between α1 and β2 are eligible for the starTRUXT starTRUXT label.